2020 has been an exceptional year. Almost everyone in the world has been affected in some way. The UK has been in and out of lockdowns and various restrictions for the majority of the last year. As of April 2021, the number of COVID deaths in the UK has almost hit 130,000. As well as the health impact, over 9.9 million people have had their jobs furloughed and 418,000 additional people are now unemployed compared to this time last year.

Given the struggles so many are facing, I am very grateful for the privileged position I am in. I work in the public sector and have not had to worry about getting furloughed, losing my job and money no longer coming in. I am able to work at home so have not had to risk my own health and the health of those closest to me by mixing with others in the workplace.

The below spending is unique to me and does not reflect situations many others find themselves in. If you are struggling financially during the pandemic, here are some resources where you can get help and advice.

- Advice for people struggling to pay essential bills because of COVID-19

- Coronavirus (COVID-19): what to do if you’re self-employed and getting less work or no work

- Financial support during COVID-19

- Coronavirus and your money

I have always enjoyed discussions about the cost of living in London. Given the current circumstances I thought it would be interesting to explore how the pandemic has impacted my personal finances.

The following calculations compare my average spend for the year before the pandemic (March 2019 to February 2020) and average spend of the year since the pandemic started (April 2020 to March 2021) .

Here are the results:

Pre-Pandemic Finances

Firstly let’s start with what I was spending before the pandemic.

For the past 2 years I have used the Yolt app to track my spending. This app integrates with my bank account allowing me to see what I have spent each month and categorise outgoings into certain groups. I am a big fan of this app as it doesn’t require having to constantly record everything and it takes account of all your various credit cards and accounts.

To calculate my pre-pandemic finances, I went back through my Yolt records and, because my spending fluctuates a lot from month to month, I took the average of each category over the year prior to pandemic restrictions in the UK.

This gives a good indication of my spending at the time, although it is not exact. Because of the haphazard way my boyfriend and I split bills, some categories include the spend for two and some categories are missing items. However this pattern is generally consistent over time.

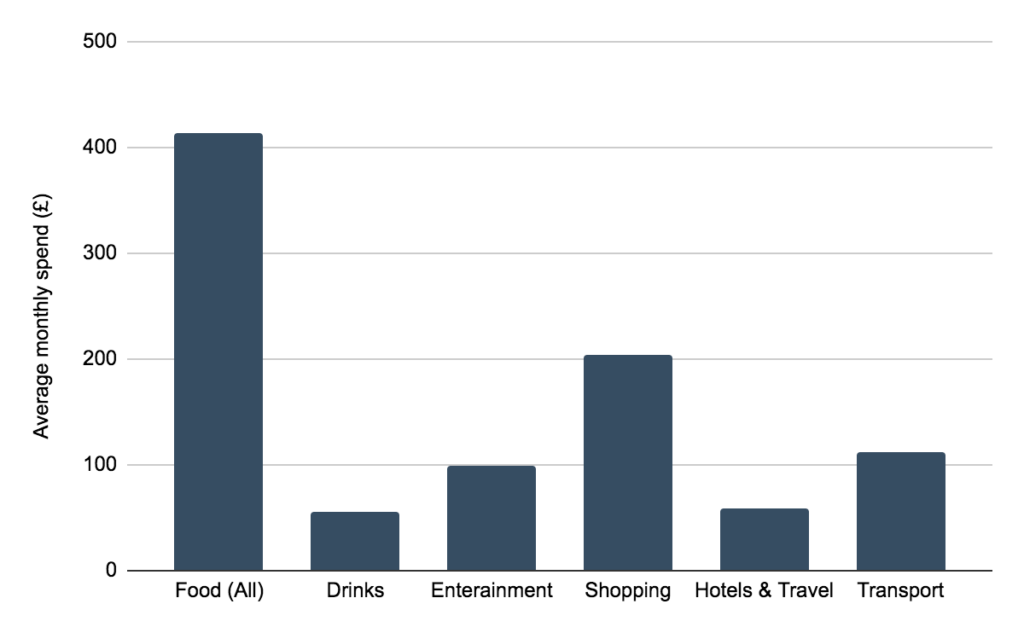

A graph of my pre-pandemic spending (March 2019 – February 2020)

The graph below shows the amount I was spending for food, drinks, entertainment, shopping, travel/hotels and transport.

I spent just over £400 a month on food.

This included supermarket shops, eating out and takeaways. I like cooking interesting meals and love eating out so I’m not surprised this is quite high. I often buy shopping to cover my boyfriend as well as myself, which has pushed up my monthly spend as well.

My next highest category is shopping at around £200 a month.

This includes other purchases such as clothes, books, household items, technology and health/beauty products. Again this seems quite high but looking at the individual months, there is a lot of variation. December is naturally very high (buying presents) and the months where I have been clothes shopping are also much higher as I tend to buy a lot in one go. The biggest single spend I can find is £152 on two pairs of shoes in October 2019.

I spent around £55 a month on drinks.

This covers takeaway coffees and drinking in bars (although not with meals as that is covered in eating out). I expect this is low compared to others as I don’t go out drinking that often. When I do go out, I tend to eat out as well so the spend would come under food.

I spent £100 a month on leisure and entertainment.

This contains things such as Spotify, Netflix, concerts, sports clubs and my gym membership. Again this fluctuated month on month depending if I bought tickets to something or not. The biggest purchase I can find is £132 on two tickets to see Nick Cave and the Bad Seeds in April 2020 which, of course, got cancelled.

I spent an average of £112 each month on transport.

This is the amount I spent on the tube/bus each month commuting to work, seeing friends around London and generally going about my normal life. Interestingly this is slightly less per year than the cost of an annual tube pass for zones 1 and 2 (£120 a month) so I probably made the right choice not buying one.

On average I spent £60 on travelling and hotels.

My final category is for travel and hotels. This includes travel out of London and the cost of hotels when I go on holiday. On average I spent £60 a month, amounting to around £720 a year. I did not go on any long holidays during this period year so this cost mainly covers visiting friends and family and short breaks.

And what about everything else?

In addition to this, roughly 50% of my salary went on rent and bills. I also automatically transferred 10% of my salary into my savings account each month.

Summary

In total, my general spending came to £944 a month, slightly higher than the £845 that numero estimates it costs to live in London. I probably won’t read too much into that though, given my spend often covered two people and I do eventually get paid back.

Pandemic Finances

I calculated my pandemic finances in the same way but between the months of April 2020 to March 2021. This covers the year from when the UK first experienced restrictions and includes 3 national lockdowns.

Interestingly it also covers the “eat out to help out” period in August 2020 where the UK government subsidised the cost of restaurant meals. During this period and over the summer generally, I spent a lot eating out to make the most of the deal and the fact we had been in lockdown for so long.

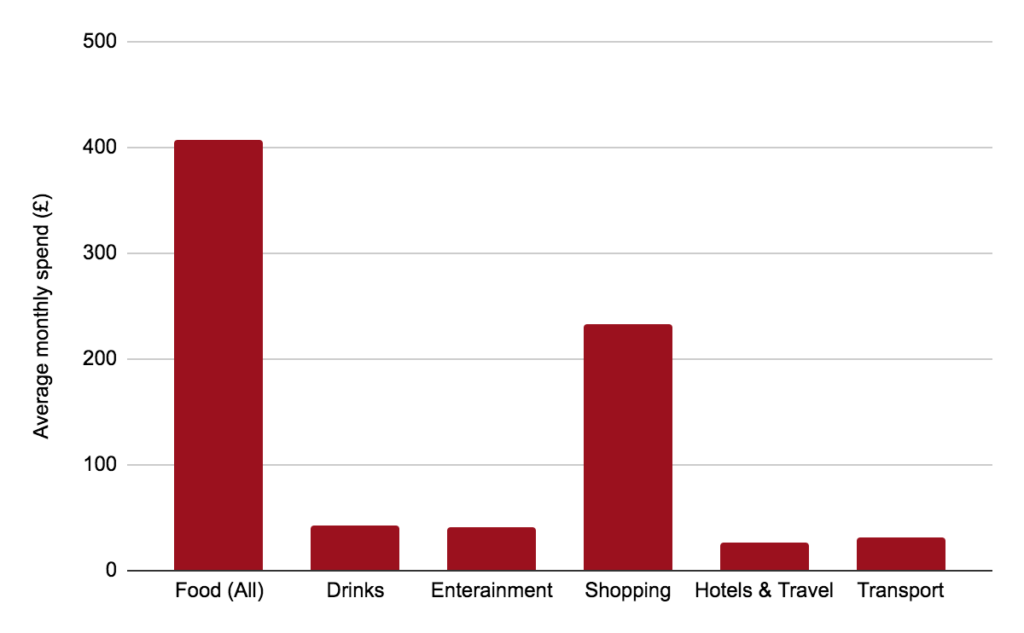

A graph of my pandemic spending (April 2020 – March 2021)

My spend on food was around £400.

This is roughly unchanged from the previous year. I was not able to spend money on eating out during most of the year and was no longer buying lunch every day at work. However my groceries spent went up as I now had to buy more food to cover my lunches. I also spent more on takeaways during this period.

I spent around £42 a month on drinks.

Within that, alcoholic drinks were reduced by 78% but the amount I spent on coffee went up by a staggering 225%. During the lockdowns, one of my favourite things to do was to go to my local coffee shop and get a takeaway coffee. Before the pandemic I used instant coffee at work and rarely spent money on posh coffees.

The amount I spent on shopping went up to £233 a month.

This is an increase of £30. I bought a couple high ticket items in the Autumn, including £699 on a new phone and £199 on headphones. Also in the summer I spent over £100 on new workout clothes.

I spent only a small amount of entertainment, holidays and transport.

The amount I spent on entertainment and leisure halved to £45 a month as I stopped buying tickets to concerts and shows. Hotels and travel reduced down to £25 a month. I went on a short UK break in July 2020 but aside from that, very little was spent.

Finally my transport costs reduced by 70% to only £30 a month on average.

Analysis

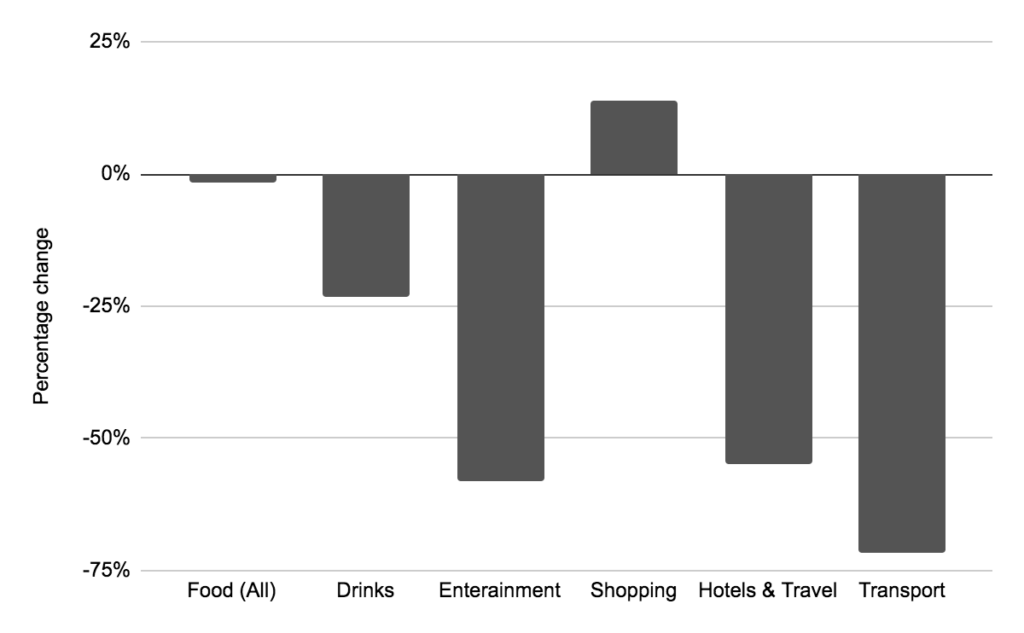

A graph of the percentage change between my pre-pandemic and pandemic spending

All my categories reduced apart from general shopping which increased by 14%.

This makes sense to me, as I felt during 2020 that because I wasn’t going out at all, I could allow myself a few more online shopping luxuries.

One problem I had at the start of lockdown was buying lots of clothes online. In particular I kept buying clothes that were only suitable for going into the office or a night out with friends. These clothes are still in my wardrobe with the labels still on. Eventually in summer 2020 I vowed to stop buying any clothes I would not wear around the house until things went back to normal. It’s easy to forget that a couple of clothes items can cost as much as a whole month of taking the tube to work.

My biggest reduction was in transport costs which went down by 70%.

While this is a lot, it feels like I barely used the tube at all in 2020 so I’m surprised it’s not lower.

This was followed by a 55% reduction in hotels & travel and 54% reduction in entertainment. Drinks reduced by 23% and food remained about the same with a 2% reduction over all.

Overall my spending during the pandemic reduced by 17%

Overall I spent £160 less per month in these categories during the first year of the pandemic compared to the previous year, a reduction of 17%. In a year I saved almost £2000. Despite my shopping habits, the stay at home message and restrictions still saved me money overall.

In my case, the pandemic benefited me financially but the impact on my mental health is a different story. Come back next month to find out about my pandemic experiences.

One Response

Comments are closed.